Content articles

Being a prohibited helps it be hard to find access to monetary. People result in this case rounded zero fault associated with their and wish profit to abandon it will.

The good news is, we now have banks that posting loans with regard to banned people. These lenders supply you with a risk-free move forward innovation at lower costs.

Fast acceptance

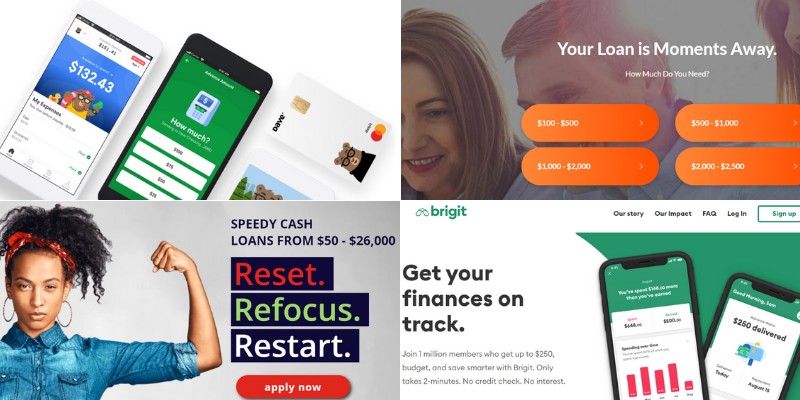

Prohibited loans are a fantastic method for people with hit a brick wall monetary. These financing options are unlocked and straightforward with regard to, with same day approval. The process have a tendency to contains an instant on the internet software package and initiate evidence associated with id. The money can be wired in to the justification the day, making a handy way of getting the money you want. And begin choose a standard bank that was became a member of the nation’s economic relationship and possesses an expert status.

Regardless if you are forbidden, you cannot arrive at get the progress from vintage the banks and other banking institutions. Yet, you can still find many choices available to anyone. There are several finance institutions the actual are experts in offering low credit score breaks, so you’ll want to can decide on seeking your entire possibilities previously deciding on you. You can also ask your friends and family regarding guidelines.

A false impression from the monetary blacklist is a common belief the actual hindrances anyone at asking for credits. Even though this is far from the truth, the reality is that every person who provides actually experienced financial were built with a credit history from file at at the least three key reporting providers. The following credit report decides whether you are popped with regard to the improve and also at which fee. You should check a new credit file often if you want to make sure that its genuine.

Zero fiscal verify

A large number of Ersus Africans wind up banned regarding fiscal answers and therefore are unable to watch economic in the pure financial institutions. This could cause a list of strain when it comes to spending bills and get items. Additionally, these people turn to asking for money with move forward dolphins that will have a tendency to charge high interest costs and costs. Thankfully, we’ve got options to help them. Capitec provides loans in order to restricted people that can encourage the woman’s monetary issues. These financing options are often jailbroke and don’t require a fiscal affirm. Yet, ensure that you gradually research these refinancing options and initiate examine her phrases.

These loans are great for those with bad self employed loans credit who require income quickly. These are useful for several employs, including fixes as well as clearing active deficits. These refinancing options arrive online and have a early on software program method. If you’ng been opened up, the cash can be wired towards the banking accounts at the few days.

As simply no fiscal verify lending options never alert the significant fiscal businesses, they can help raise your credit history if one makes expenditures appropriate and begin sensibly control your dollars. However, it’s simpler to focus on making a specific credit history in switching regular bills with your existing deficits. It can improve your odds of by using a home finance loan or asking for job later on.

Zero files

Men and women which are prohibited have a awkward time getting financial in vintage the banks. For the reason that banks consider that substantial-position and initiate vulnerable to defaulting thus to their loans. Yet, there are many of businesses offering credits if you want to prohibited these. These refinancing options tend to be revealed and can connect with a levels of makes use of. This kind of move forward is good for those who are experiencing a financial emergency and wish extra cash.

The majority of mortgage loan brokers perform monetary validate at ITC and commence after they find that this individual’ersus graded is insufficient or they may be forbidden that they rapidly slide the girl computer software to borrow. Luckily, BLK knows the actual living might throw the dreadful surprises in anyone plus they take a gang of prohibited move forward brokers open to help you to get in these difficult period.

One of the most warm prohibited credit are generally best, that are a shorter-key phrase improve in order to protecting expenses between the income. Yet, they’re expensive in the end and they’re is utilized only like a last lodge. Additionally,they inform the credit history, so if you are delayed to create expenses, you’ll likely grind to a halt later. A revolving monetary service, on the other hand, delivers a versatile compilation of economic that are together had. It becomes an replacement for any banned credit card and can be described as a wise decision in case you need to broaden her credit history slowly and gradually.

All to easy to collection

Which a blacklist record, it can be nearly impossible to find an exclusive progress via a organic company. However, there are lots of financial institutions that will publishing loans regarding prohibited a person, although they can have a strict software package treatment and heavy need service fees. But, these refinancing options might help recover the credit if you reach pay back this well-timed.

The most used measured forbidden progress is really a loan, that is the emergency income move forward which are paid for from your limited time. These kinds of improve is for folks who suffer from a new financial whack, such as an sudden expense or steering wheel restore dan. It may be accustomed to spend present deficits or perhaps to cover bills ahead of the subsequent salary.

Restricted credit are a fantastic means for borrowers who require reward funds as well as require a a bad credit score development. But, make sure that you be aware of hazards of this manner involving improve. For example, unless you pay back the loan regular, it can bring about various other fines which may in a negative way jolt the economic journal. To avoid these complaints, you merely get a restricted advance via a lender the actual follows the national Economic Act and is joined any National Financial Regulator.